This post was inspired by Jordi Alexander’s Tweet thread on the same topic.

Despite a recent downturn in crypto and DeFi, NFT markets have been booming: according to NonFungible.com, there are $885 million worth of NFT sales per week as of February 1. This still pales in comparison to the all time high of $1.7 billion per week back in late August 2021, indicating there could still be some room to grow:

From NonFungible.com

While famously, OpenSea has dominated the NFT market, a recent entrant into the space has been LooksRare, a “community-first NFT marketplace with rewards for participating.” In contrast to OpenSea, LooksRare has a “crypto-native” feel to it, having been developed by an entirely anonymous team. What’s more, it boasts its own ERC-20 token, LOOKS, which it uses as an incentive for usage of its platform.

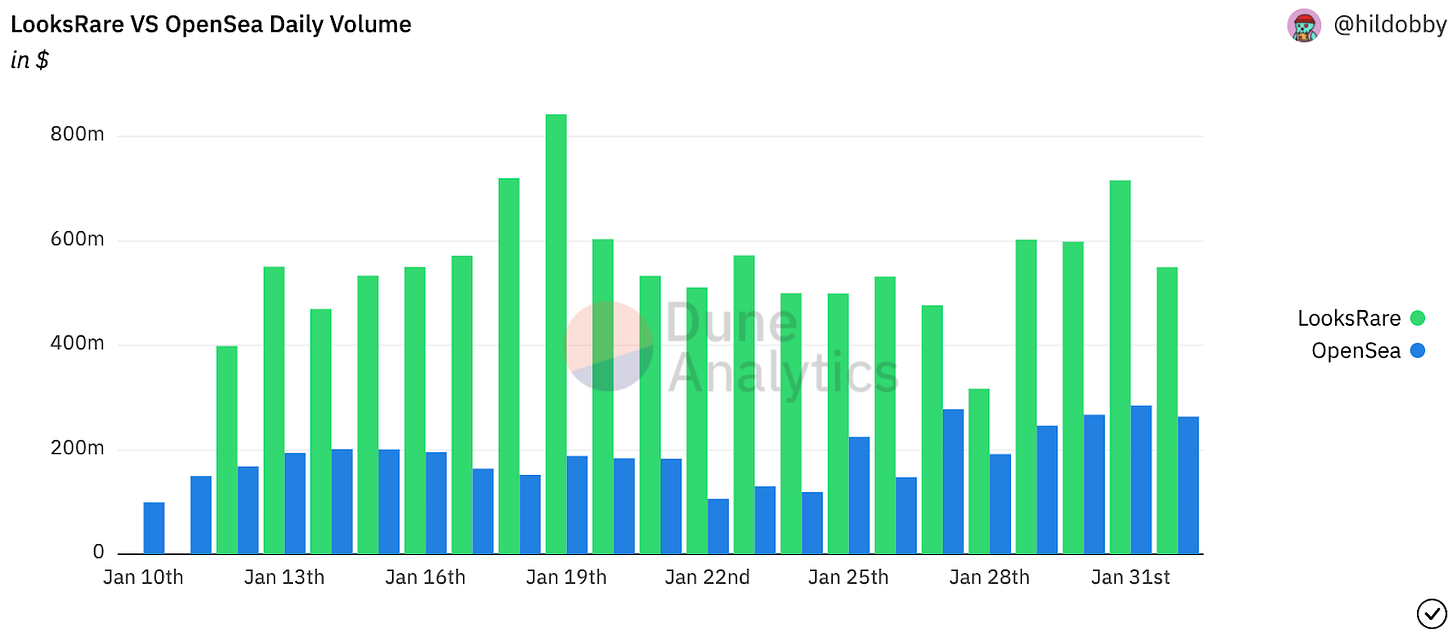

On first glance, the strategy seems to be paying off: a Dune dashboard by @hilldobby tells us that LooksRare is consistently doubling OpenSea in trading volume almost every day:

And yet on any given day, OpenSea has 20 - 40 times more active users than LooksRare:

How does this make sense? What accounts for this discrepancy? The answer lies in the way that LOOKS rewards are structured.

TLDR

LOOKS is not a governance token; it is a purely monetary ERC-20.

The intrinsic value of LOOKS comes from the 2% platform fees that LOOKS charges on every NFT trade.

Wash trading drives LooksRare volumes, but in aggregate, the trading & royalty fees cancel out the LOOKS rewards disbursed.

LooksRare is just one example of the intersection of NFTs and DeFi tokenomics.

LooksRare Rewards

There are three mechanisms that drive yield on LooksRare: staking rewards, platform fees, trading rewards, and.

Staking Rewards

First, LooksRare allows users to stake any LOOKS token they may hold. As should be familiar to Incentivized readers by now, this means locking up their tokens in a contract, thereby decreasing circulating supply and increasing the price of LOOKS. In return for staking LOOKS, users receive additional LOOKS rewards in proportion to the amount of LOOKS they have staked.

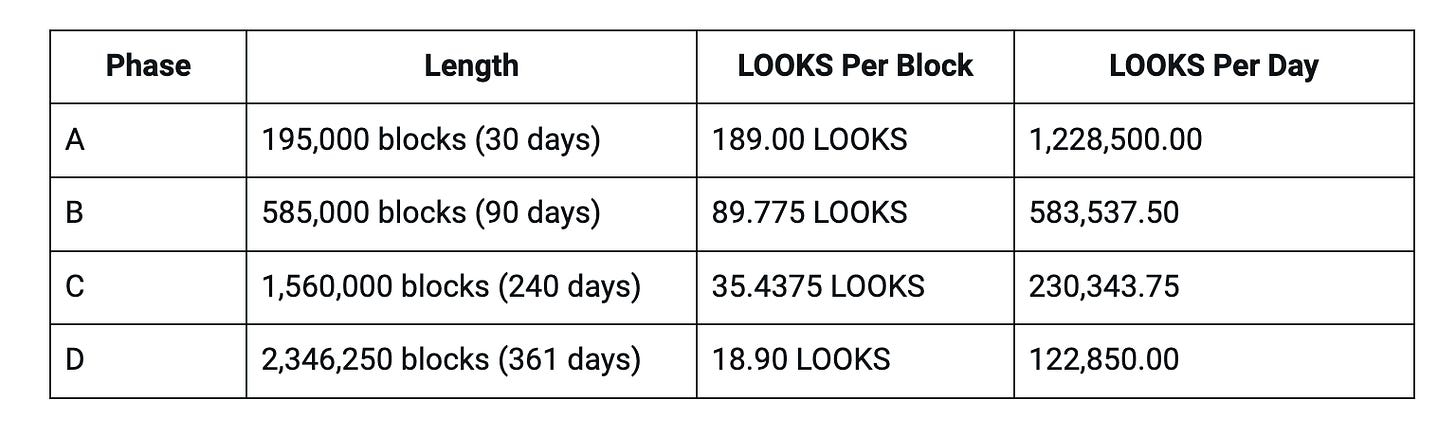

Unlike rebasing tokens, however, LOOKS inflation is bounded. The total amount of rewards disbursed per day decreases over time according to the following schedule from the date of LooksRare launch:

So, for example, if there are currently 1,000,000 LOOKS staked, and a user has staked 100 of their LOOKS during phase A, then they could expect to gain 0.01% * 1,228,500 = 122.8 LOOKS per day.

Staked LOOKS “auto-compounds”, which means that rewards are automatically staked as well. This is a similarity to rebasing tokens, whose staked balance grows automatically every epoch. The difference, though, is that this does not happen indefinitely - after 721 days, there will be no more LOOKS rewards.

Platform Fees

LooksRare collects a 2% platform fee on every trade. So if a seller lists an NFT for 10 ETH, the buyer will have to pay 10.2 ETH.

What happens to that 0.2 ETH? It is distributed to LOOKS stakers in the form of WETH (wrapped ETH, basically ETH but just in ERC-20 format) in proportion to the amount of LOOKS staked. At the end of each recurring 6,500 Ethereum block period (roughly 24 hours), these WETH rewards vest linearly over the subsequent 6,500 period and can be harvested by LOOKS stakers.

Analysis

Two interesting aspects of LOOKS stand out at this point:

LOOKS is not a governance token; it is a purely monetary instrument. Nothing in the documentation suggests that LOOKS provides users with voting power or ability to control the overall protocol. This stands in stark contrast with tokens like CRV, which allow users to vote-escrow to vote indirectly on subsequent allocation of CRV.

The fundamental value of LOOKS is in the platform fees. (This assumes that WETH has intrinsic value, but if you are reading this, I probably don’t need to convince you of that.) It’s reasonable to consider the price of LOOKS to be the discounted sum of all future platform fees after accounting for dilution due to staking inflation.

Trading Rewards

The most distinctive characteristic of LooksRare is that it pays its users to buy and sell NFTs. This payment is made with LOOKS ERC-20 tokens in proportion to the ETH value of NFTs you bought/sold on a given day. The price of LOOKS, relative to ETH, is determined by a LOOKS/ETH liquidity pool on Uniswap. The total amount of rewards disbursed by LooksRare decreases according to the following schedule from LooksRare launch.

The immediate question this raises is: what’s to stop somebody from trading a single NFT back and forth between two addresses they own arbitrarily many times at an arbitrarily high price? The answer is nothing - users are free to do this. This is why LooksRare trading volume is so high: users are wash-trading their NFTs between their own address to generate rewards in the form of LOOKS.

But does this even make sense to do? Let’s take a “LOOK.”

Analysis

As noted in “Platform Fees,” for every trade, there is a 2% fee the buyer must pay to LooksRare as a. Furthermore, typically NFT series demand a royalty fee anywhere be paid to them: for example, Bored Ape Yacht Club commands a 2.5% royalty fee.

Suppose I list my Bored Ape for 100 ETH, and I buy it from another one of my accounts. That means I will spend 2 ETH on the platform fee to LooksRare, and 2.5 ETH on the royalty fee to Yuga Labs. (Yes, that’s my name, and it’s a total coincidence!) Let’s further suppose that I do this N times.

Recently there have been roughly $600M in trading volume every day on LooksRare, or ~240,000 ETH. That means:

My trading volume will consist of 2 * 100N / 240,000 = N / 1200 of the total.

This entitles me to (N / 1200) * 2,866,500 = 2,388 * N LOOKS in trading rewards.

However, I must pay 4.5 * N ETH in platform and royalties.

Thus, I make a profit if 2,388 LOOKS > 4.5 ETH, or if 1 LOOKS > 0.0018844 ETH

And if you look at the current price of LOOKS / ETH, it is very close to that break-even price:

From CoinMarketCap

This makes sense, because one would expect the market to reach equilibrium such that, in aggregate, the amount of fees paid to trade are equal to the amount of trading rewards disbursed. Of course, the analysis above is simplified because it ignores the feedback loop of my trading contributing to the total trading volume, but at the margin, this is reasonable, because most traders cannot meaningfully increase a $600M trading volume.

What this means is that earning LOOKS by trading on LooksRare is equivalent to trading ETH for LOOKS: you believe that the price of LOOKS relative to ETH will go up. And if total trading volume goes up, the platform fees will increase, which will contribute to the intrinsic value of LOOKS.

Conclusion

LooksRare incentivizes trading on its platform through the distribution of staking rewards, platform fees, and trading fees. The staking rewards are inflationary but not unboundedly so like with rebasing tokens. The platform fees define the intrinsic value of LOOKS, which, unlike many of its counterparts, is not a governance token. The wash trading that occurs to generate trading fee rewards drives the vast majority of the volume on LooksWare, but in aggregate, the fees paid cancel out the rewards, as expected.

LooksRare is an exciting experiment at the intersection of NFT and DeFi tokenomics. We can look forward to more examples of this type of product, including The OpenDAO and NFT PawnShop.

Subscribe & Share

If you enjoyed this post, and would like to keep up with the latest news on on-chain culture and cryptographic capital, please subscribe and share!

Any views expressed on Incentivized are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

I just read through every article you've written on this substack - easily the best writing on defi I've come across so far, nice work. I very much appreciate the walkthrough of the math and equations underlying these protocols, nested inside the overall plot of defi events... Do you have any recommendations for other writing of similar quality?

why is N / 1200 of the total in the formula? thank you in advance