How Tokemak Solves the DeFi Liquidity Problem

Tokemak, Reactors, and TOKE

“Liquidity” is one of the most oft-used terms in DeFi, but it is also a nebulous and ill-understood concept. In this article, we explore what precisely “liquidity” means in DeFi, the problems that liquidity presents, and Tokemak’s proposed solution to those problems.

TLDR

Liquidity is the ease with which an asset can be converted into other assets, and a critical property of successful DeFi tokens.

Two principal hurdles to achieving liquidity + price stability in DeFi are:

Impermanent loss

Instability of Pool 2s

Tokemak offers a solution by eliminating the requirement for token-pairing in providing liquidity

It acts as a layer on top of DEXs, deploying the liquidity it receives to traditional liquidity pools

While there are risks with this model, Tokemak accounts through its guardrails

Definition

Investopedia offers the following definition of liquidity: the “ease with which an asset or security can be converted into ready cash without affecting its market price.” But how can this definition apply to crypto, where: 1) the ethos is orthogonal, if not antithetical, to fiat currency (i.e. “ready cash”), and 2) there is great debate about whether cryptocurrencies are “securit[ies]”?

We offer the following amendment to the definition for cryptocurrencies: liquidity is the ease with which an asset can be converted into other assets without affecting market price. This definition removes the dependency on “cash”, and instead reframes liquidity as a property of an asset in relation to all other assets.

It is self-evident that some assets are more liquid than others. Consider, for example, NFTs. Relatively speaking, NFTs are illiquid assets in three ways. First, there are only a set of certain currencies that you can sell your NFTs for - on OpenSea, these include ETH, WETH, and USDC. There is no built-in mechanism to sell your NFTs for CVX, OHM, or SPELL. Thus, NFTs are illiquid in the sense that they cannot easily be converted to these other assets. Second, even if your NFT is listed in one of the supported assets, it can take hours, days, weeks, or an infinite amount of time before your NFT sells. To convert your NFT into another asset, you need to find a buyer that is willing to pay the listed price. Thus, NFTs are illiquid also in the sense that there is no automated market for them. Lastly, because NFTs are non-fungible, the only market price for it is the price you sell at. So NFTs are illiquid in that selling them always affects the market price.

Compare this to, say, ETH. Relatively speaking, ETH is very liquid, because most assets have an ETH-paired liquidity pool on AMMs. If I want to convert my ETH into an arbitrary shitcoin, so long as that shitcoin-to-ETH-pair is listed on Uniswap, Sushiswap, or any other number of DEXes, I can do so immediately. And, unless I am swapping an absurdly large amount, the trade will likely not affect the market price of ETH.

Significance

There are two answers to the question of why liquidity is important. The practical answer is that liquidity is a form of utility. This is intuitive in the world of fiat, where cash is by definition the most liquid asset. Theoretically, I can convert cash into any asset, whether it is a bond, an equity, a mortgage, a computer, or groceries, which makes it useful. In contrast, I cannot convert a share of Coinbase stock into a computer directly - I would have to sell it for cash, and then buy the computer with the cash (and I would be taxed for my sale of the stock). Thus, the liquidity of cash makes it useful.

Similarly, in the world of cryptocurrency, liquid assets are useful because they can easily be converted to other assets without affecting the price. I can convert my ETH to almost any other asset directly via Uniswap. I can even convert my ETH into blockspace directly by using it as gas for a transaction. The same cannot be said about other, less liquid assets.

A more theoretical answer to why liquidity is important is that liquidity provides the information necessary for an efficient market. In the ideal scenario, prices in a market correspond accurately to the value of the underlying asset and reflect all available information. When assets are mispriced, arbitrageurs can take advantage by buying and selling it on different markets until the price equilibrates and reflects the underlying value. If an asset is illiquid, it cannot be converted without significantly affecting its price - therefore, the price will intrinsically be more volatile, and not necessarily reflect the underlying value of the asset.

For these reasons, liquidity is critical for an asset to be useful and for its price to be informative. In particular, if you want people to buy and hold an asset, then it needs to be easy to convert other assets into that asset, and there needs to be incentive for holding the asset, which is difficult if the price is too volatile.

Achieving Liquidity

Suppose you are a new DeFi protocol with a native token. The token probably has some utility - it may entitle holders to vote on governance, it may accrue value through fees that the protocol accumulates, or perhaps it promises future airdrops. As developers and creators of the protocol, a non-trivial portion of your compensation is in the form of these tokens, but your tokens are locked up and vest over some period of time, maybe two or three years. Obviously, you want the price of the token to go up. The best way of doing that is: 1) give users easy avenues for buying the token (i.e. making it liquid), but also 2) providing incentives for holding and not selling the token. How can you do that?

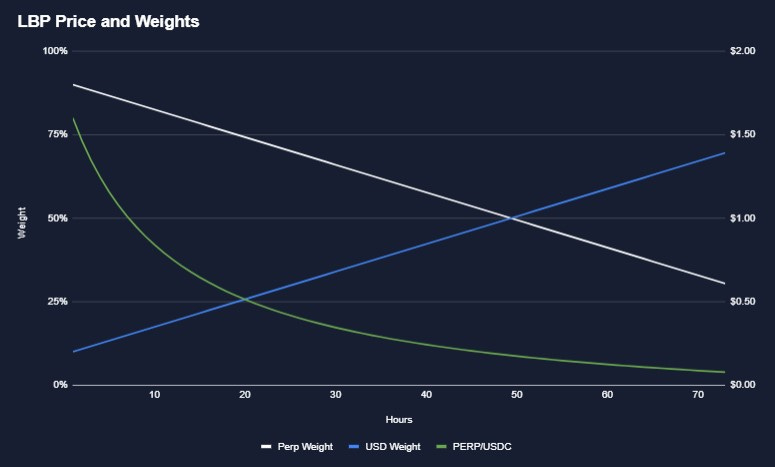

The “traditional” avenue for achieving this initial liquidity is through liquidity bootstrapping pools (LBPs), of which the Balancer implementation is probably the most famous. In the “Tokenomics” documentation of most DeFi projects, you will find that a significant portion (~10%) of the token allocation is usually reserved for liquidity bootstrapping. The way this works is for the project team to deposit the tokens, as well as a collateral asset such as ETH, in some proportion, into the pool. The LBP allows users to buy the token with the collateral asset, thereby decreasing the ratio of token-to-collateral in the LBP. Of course, any pre-existing holders of the token can sell into the LBP as well to receive the collateral asset. The usual AMM dynamics of the constant-product are at play here, so eventually, the ratio of token-to-collateral stabilizes, and an implied price of the token comes to be.

From Delphi Digital

Once a price for the token (denominated in the collateral asset) has been established, the token is somewhat liquid. To increase liquidity further, teams and investors can then create liquidity pools on DEXs like Uniswap for various other assets: deposit the protocol token and another asset in equal-value-proportion, and receive LP tokens in return. The LP tokens entitle the holder to a portion of the trading fees on the pool, but the risk they are exposed to is volatility of the underlying assets resulting in impermanent loss.

So following this process has achieved the first goal of giving users an easy way of buying the token. But DEXs and AMMs are two-way streets - you can just easily sell the token as well. How can we provide additional incentives for not selling the token?

If you’ve been reading this Substack, you should have guessed “staking”, and you’d be right.

Pool 2

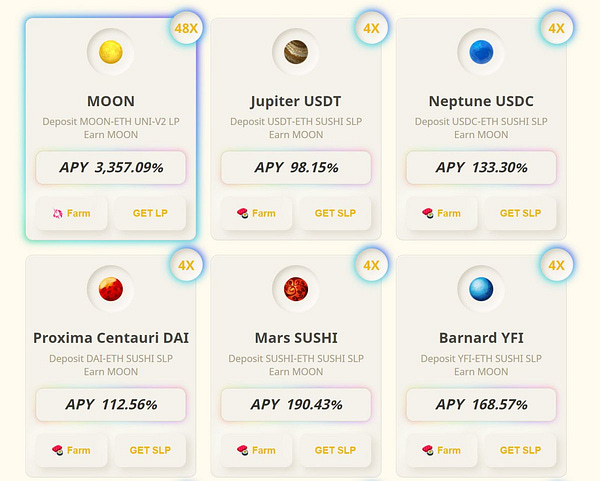

The so-called “Pool 2” is a DeFi pattern for this purpose. These are staking contracts that disburse rewards denominated in the protocol token, but the asset staked is an LP token that has exposure to the protocol token.

To make this concrete, suppose I have a DeFi protocol token, YUGA. I have bootstrapped liquidity for YUGA through a Balancer LBP, and the stable ratio is 100 YUGA per 1 ETH. I’ve also deposited 10 ETH and 1000 YUGA into a Uniswap pool, and I consequently have 100 YUGA-ETH LP tokens. A Pool 2 would allow me to deposit those 100 YUGA-ETH LP tokens, and receive rewards in the form of more YUGA tokens.

Analysis

What are the incentives at play here? Certainly, by staking your YUGA-ETH LP tokens, you are less likely to sell that initial amount of YUGA you provided to the LP, because there is friction to doing so (unstaking and selling). What about the additional YUGA you win as rewards?

You could sell that additional YUGA for some other asset. But depending on how liquid YUGA is, that would drive the price of YUGA down, and consequently, you would suffer impermanent loss on your original YUGA-ETH position. In other words, your LP token risk and YUGA risk are correlated. For this reason, Pool 2’s offer extremely high APYs, the mechanics of which we covered in a previous article.

Pool 2’s do incentivize participants to hold the DeFi protocol token, achieving the second goal we stated. But they end up turning into a game of chicken, where a drop in the price of the token can lead to cascading liquidations, because not only the rewards become less valuable, but the value of the asset staked also declines in value.

Tokemak

To summarize, two principal problems that DeFi protocols face when trying to achieve liquidity for their tokens are:

The risk of impermanent loss that LPs face, and

The unreliability of Pool 2s as a mechanism for incentivizing not-selling the token.

Tokemak, self-described as “the utility for sustainable DeFi liquidity,” is a product that aims to solve these problems. Fundamentally, it achieves this by decoupling the requirement of token-pairing when providing liquidity, by occupying a layer above the DEXes themselves.

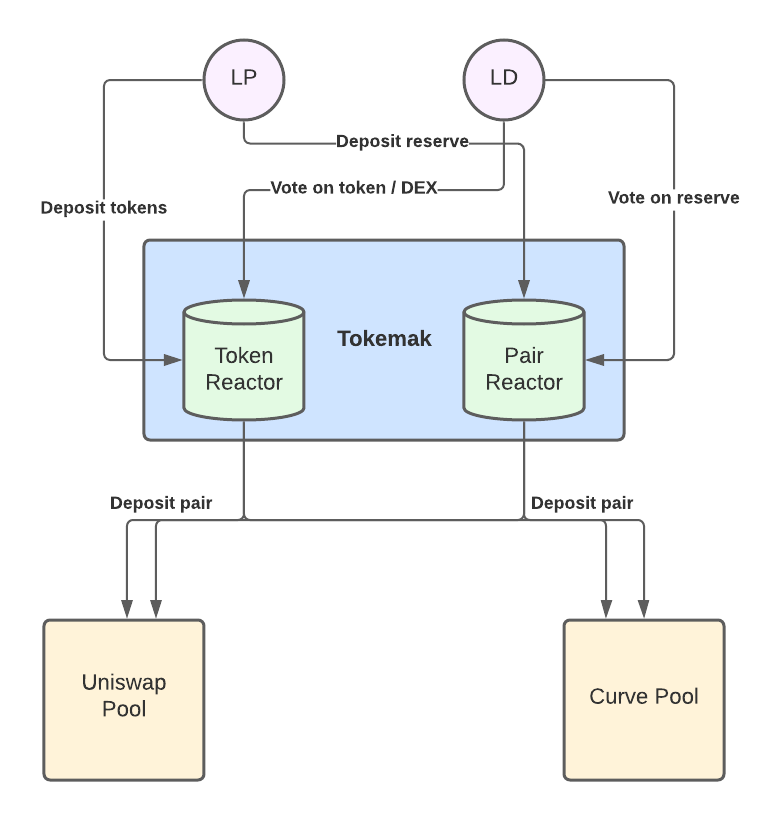

The Tokemak Ecosystem.

The native token of Tokemak is TOKE. The analogue of a pool in Tokemak is known as a “reactor,” and there are two types of reactors: “pair reactors” and “token reactors.” For both types of reactors, there are two types of participants: liquidity providers, and liquidity directors (LDs).

A typical token reactor.

The role of the liquidity provider is to stake the single asset of the reactor; in return, they receive TOKE rewards. Note that this alone means that LPs are not directly exposed to the risk of impermanent loss, because IL results from variation in the relative value of a pair of tokens.

The role of the liquidity director is to stake their TOKE, and vote on things. The things they vote on depend on the type of reactor:

For “token reactors,” they vote on a token and which DEXs the token should be deployed to as liquidity.

For “pair reactors”, they vote on a reserve asset for Tokemak’s treasury and guardrails (discussed below). These also serve as one side of the pairs deployed to DEX LPs. Thus these reserve assets are very liquid assets and stablecoins, such as ETH, USDC, and FRAX.

In return for their staked TOKE and votes, LDs receive TOKE as rewards.

The assets in token reactors are then paired with assets in pair reactors, then deployed in pairs as liquidity to traditional pools on DEXs. The trading fees from this LPing accrues to the Tokemak treasury, which is part of what gives TOKE value. Note that not all of this liquidity is deployed to DEXs - only a certain portion of it, for reasons outlined below.

The critical element here is that the mathematics for determining both LP and LD TOKE rewards are configured in such a way that TOKE rewards are maximized for each party when the amount of liquidity for both reserve assets and tokens are maximized. From an article by Tokemak:

Tokemak is a kingmaker for [reserve assets]: the Pair asset with the most TOKE staked to it will naturally attract the most TVL for that [reserve asset], thereby appointing that asset the one with the most pairings and liquidity across DeFi.

The Tokemak LD equations.

The incentive alignment of maximal liquidity deployed to DEXs leading to maximal rewards for reactor LPs is part of what makes Tokemak so attractive. Furthermore, this mitigates the Pool 2 risk of getting users to hold the token, because the Tokemak protocol is designed to hold the token through its LP position and the tokens in its reserve.

Risks

Of course, like with almost any other DeFi protocol, there is the difficulty of valuing the native token TOKE, given its multi-pronged utility (staking, liquidity direction, treasury accrual). Coming up with a “fair price” for a token like TOKE is intrinsically difficult.

The more systemic risk has to do with the impermanent loss of the liquidity deployed by Tokemak. When LPs deposit their tokens into reactors, they receive an equal number of tAssets in return, which entitle them to withdraw their submitted tokens at a future point in time (at least 1 cycle = day in the future). But if the price of the token goes up or down, then there will be impermanent loss in the underlying DEX LPs that Tokemak deployed those tokens to. So how can Tokemak guarantee that the original LPs will be made whole, i.e. that they will receive an equal number of tokens to tAssets they hold?

Tokemak achieves this through guardrails. As mentioned, they do not deploy all of the staked assets to DEXs. In essence, they show that if a token goes up in price by 100%, so long as they have deployed no more than 3 times the amount of the token they hold in a reserve, they will be able to make LPs whole. This is a parameter that is set by the protocol.

What happens if a token goes up more than 100%? Then Tokemak begins drawing on its surplus from other reactors, as well as its revenue from LP trading fees. In the worst case, Tokemak will sell staked TOKE, as well as reserve assets in its treasury, to make Toke whole.

Thus, while the risk of direct impermanent loss is mitigated through the decoupling of LP-able pairs via separate reactors, there is nevertheless a risk of indirect impermanent loss in the underlying liquidity pools. Tokemak systematically accounts for this case through its parameters, at least up to a token price increase of 100%, but beyond that there may be a risk of staked TOKE and reserve assets.

Conclusion

Liquidity is the ease with which an asset can be converted into other assets, and a critical property of successful DeFi tokens. Two principal hurdles to achieving liquidity in DeFi are impermanent loss and the instability of Pool 2s. Tokemak offers a solution by eliminating the requirement for token-pairing in providing liquidity, thereby removing the risk of direct impermanent loss. It acts as a layer on top of DEXs, with liquidity directors deciding on which reserve assets are used for pairing, and which DEX pools the liquidity is directed to. While there are risks with this model, Tokemak accounts for them by keeping a certain amount of the tokens in its reserves to ensure it can make LPs whole.

Subscribe & Share

Any views expressed on Incentivized are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

Basically you are exposed to counter-party risk in the same way as any other staking activity. You have to trust Tokemak does what it says it does and if the price rise is more than 100% it can make you whole again.